When I started my first year of university, I didn’t think about managing my finances at all. But, university was the first time I had to independently manage my finances as an adult and budget my own spending. Of course, everyone’s financial situation is different, but I thought I’d write today about some of the strategies I've learned to budget and manage my finances during university.

Track Your Spending.

For me, university life has a lot of freedom, and it was easy to go crazy on non-essential spending. Keeping track of my spending was so important for holding myself accountable and feeling in control of my finances. Even just the act of writing down everything I spend has been helpful for preventing me from making irresponsible purchases and feeling in control of my finances.

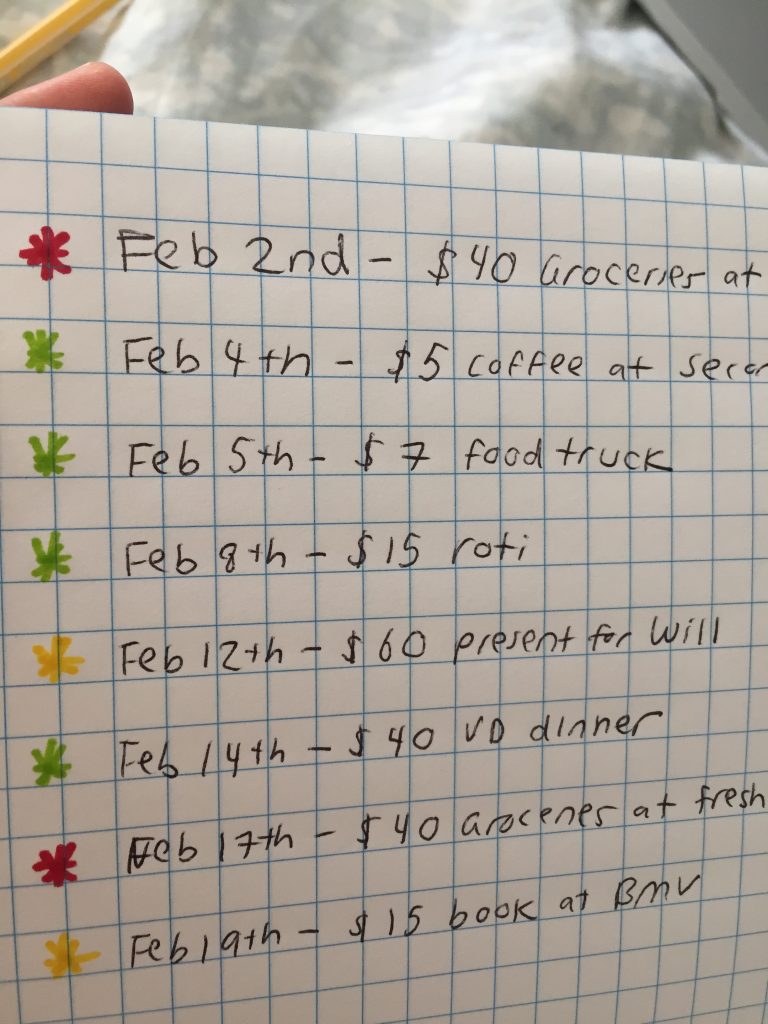

In order to track my spending, I’ll write out everything I spend in a day and make a note of what category each expense belongs to. The categories I personally use are Fixed Expenses (rent, utilities, etc), Groceries, Restaurants, Transportation, Toiletries/Household Essentials, Entertainment, and Retail.

Once I’ve tracked my spending for a couple months, I can really see how much I spend per month and notice if I’m spending an abnormal amount in any category.

Target Non-Essential Spending.

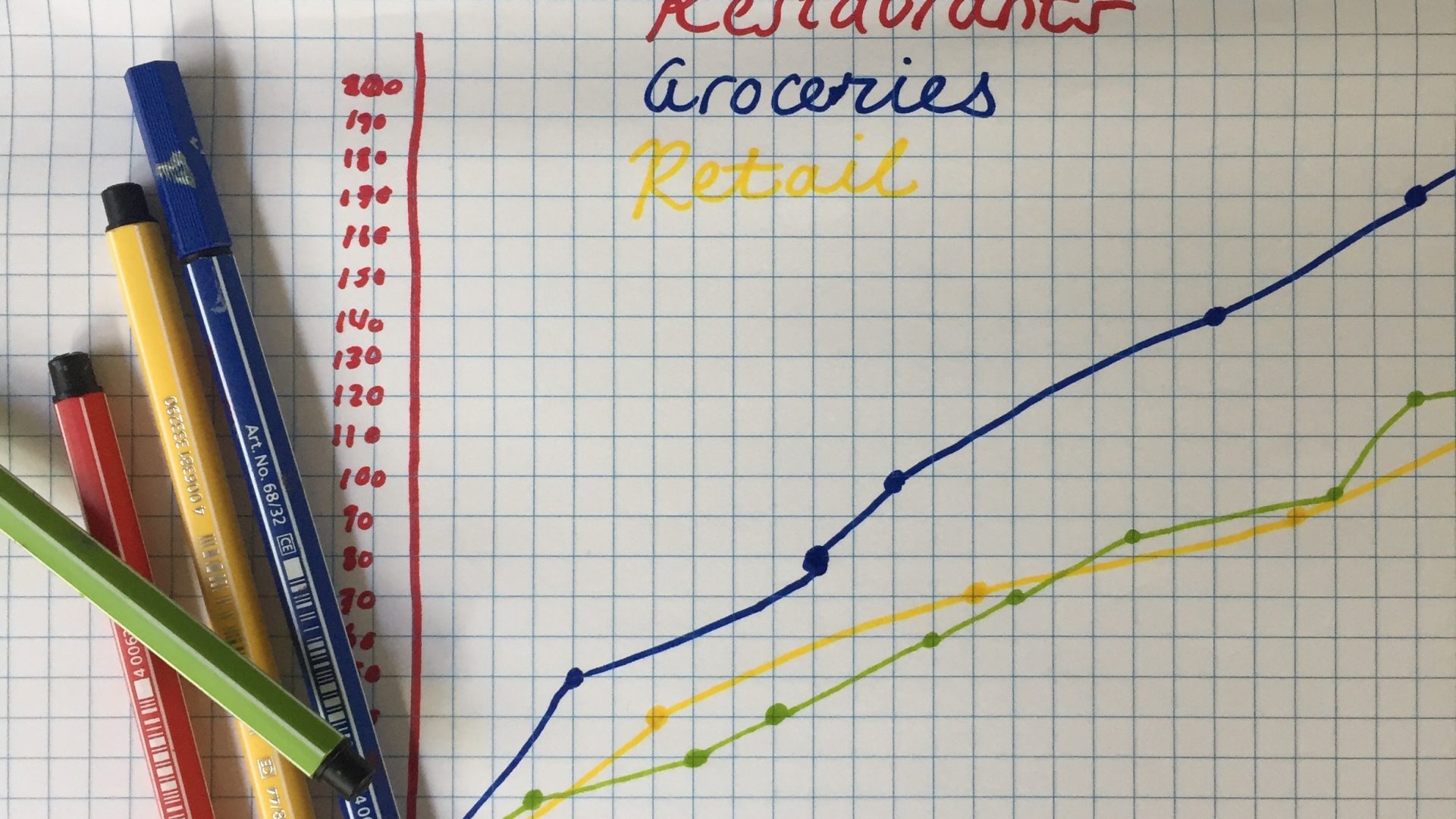

Once I’ve tracked my spending for a couple months and gained information on my spending habits, I look at non-essential categories I’m spending on — like Retail and Restaurants — and see whether I can cut down. For example, I spend a lot of money at restaurants because buying food is so convenient on campus. But, noticing this tendency has really encouraged me to spend more on groceries to get easy to make lunch foods, which ultimately cuts down my spending on restaurants and my total monthly spending.

I find targeting these areas of non-essential spending allows me to save money, but not feel like I need to cut corners in more essential categories like Groceries and Transportation.

Gain Financial Literacy Skills.

As I mentioned, university was the first time in my life I felt like I had control over my finances. As such, I started thinking about my finances post-university, considering things like student debt, taxes, credit, etc.

If these are things you're also thinking about, I highly recommend checking out the Hart House Finance Committee! Their workshops and online resources have been super helpful for my understanding of complicated financial topics. Finances can be confusing and intimidating, but help from resources like these has really allowed me to feel confident and knowledgable when managing my own finances.

0 comments on “Managing Your Finances During University”