Budgeting and Finances are things that I rarely thought about in high school. I was one of those kids who had an allowance all the way up to sophomore year and didn't think too much about saving the money I had. That all changed last year, when I began living by myself in Toronto while my parents stayed halfway across the globe. I had a recently set up chequing account in my name and was ready to face the world. Here are some tips that I picked up over the past year to manage how much I'm spending.

Recording Where My Money Goes

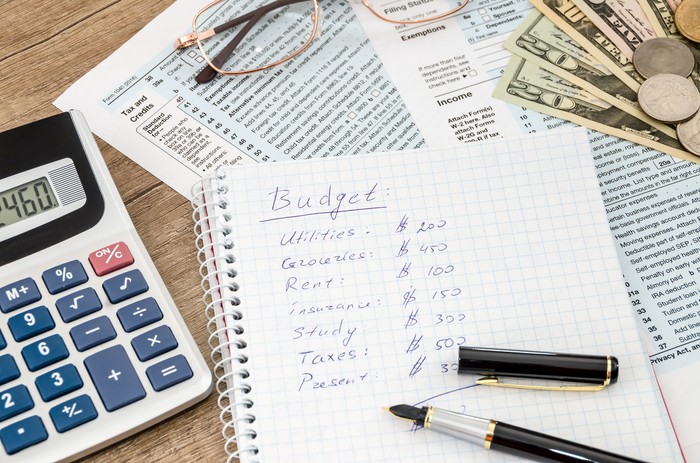

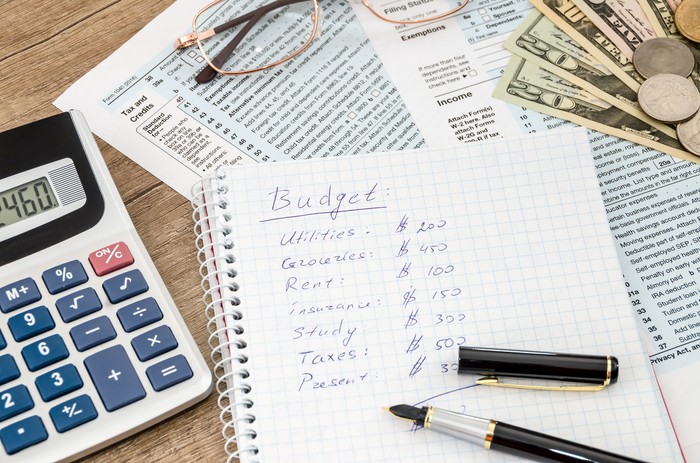

I recorded my spending habits every month and divided my spending into fixed costs, food, disposable income, etc, to determine how much I'm spending in each category. Doing this can help you identify parts of your life that you're spending too much in.

I then totaled my monthly income, and subtracted my personal necessities from that income, to get my discretionary expenses. Discretionary expenses are expenses that are used to finance things that are more 'want' than 'need'.

Spending in Cash

I'm very visual, and find that when I use my debit/credit cards I tend to spend more recklessly. To combat that issue, recently I've been taking out cash instead, and find that this has been helping me stick to my budget.

Paying Back my Credit

To prevent high interest rates from stacking up, I make sure to pay back my credit card every month. Paying back the amount owed and not just the minimum payment due is not only beneficial in the long run, but also builds a good credit score. Building a good credit score early is important for future endeavors, such as renting apartments or obtaining loans.

Setting Aside Savings

One of my resolutions for 2019 was to start setting up savings, and I have been setting a certain percentage of my income into my separate savings account. Setting aside a bit each month may not look like a lot, but it can add up to a significant number in a few months to a year.

There you have it, budgeting and finance for dummies. Although I'm only in first year and have a lot to learn in terms of managing my personal finances, I think this is a major improvement from my allowance days. It's never too early to manage your spending habits.

-Joanna

Spending in Cash

I'm very visual, and find that when I use my debit/credit cards I tend to spend more recklessly. To combat that issue, recently I've been taking out cash instead, and find that this has been helping me stick to my budget.

Paying Back my Credit

To prevent high interest rates from stacking up, I make sure to pay back my credit card every month. Paying back the amount owed and not just the minimum payment due is not only beneficial in the long run, but also builds a good credit score. Building a good credit score early is important for future endeavors, such as renting apartments or obtaining loans.

Spending in Cash

I'm very visual, and find that when I use my debit/credit cards I tend to spend more recklessly. To combat that issue, recently I've been taking out cash instead, and find that this has been helping me stick to my budget.

Paying Back my Credit

To prevent high interest rates from stacking up, I make sure to pay back my credit card every month. Paying back the amount owed and not just the minimum payment due is not only beneficial in the long run, but also builds a good credit score. Building a good credit score early is important for future endeavors, such as renting apartments or obtaining loans.

Setting Aside Savings

One of my resolutions for 2019 was to start setting up savings, and I have been setting a certain percentage of my income into my separate savings account. Setting aside a bit each month may not look like a lot, but it can add up to a significant number in a few months to a year.

There you have it, budgeting and finance for dummies. Although I'm only in first year and have a lot to learn in terms of managing my personal finances, I think this is a major improvement from my allowance days. It's never too early to manage your spending habits.

-Joanna

Setting Aside Savings

One of my resolutions for 2019 was to start setting up savings, and I have been setting a certain percentage of my income into my separate savings account. Setting aside a bit each month may not look like a lot, but it can add up to a significant number in a few months to a year.

There you have it, budgeting and finance for dummies. Although I'm only in first year and have a lot to learn in terms of managing my personal finances, I think this is a major improvement from my allowance days. It's never too early to manage your spending habits.

-Joanna

0 comments on “Budgeting for Dummies: How I Manage my Finances”