Written by: Ellie Kim, Writer & Social Media Coordinator

Financial planning can be difficult to do – it is often challenging to balance needs and wants while also planning for potential unexpected costs. The Family Care Office has compiled a list of resources and tips to help you figure out the best way to plan financially as a student while considering academia, personal duties, and finances.

Creating a Budget

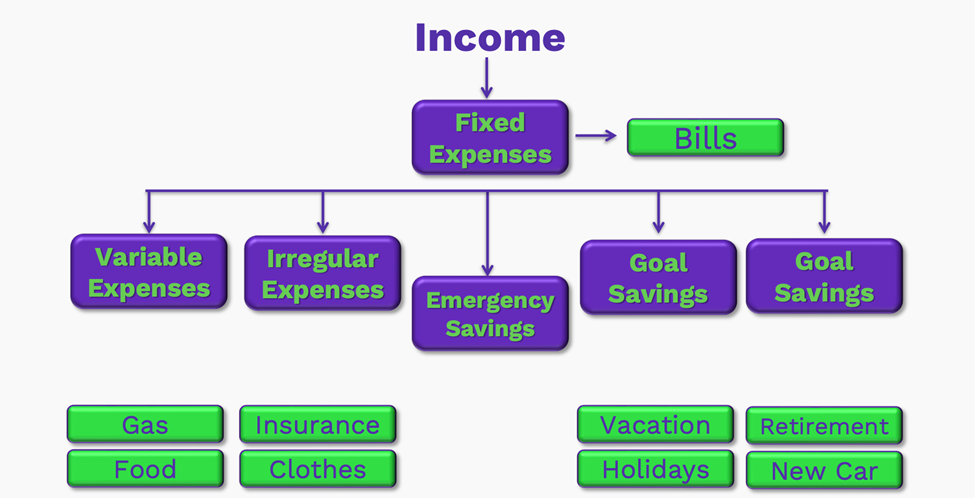

The first step in financial planning is creating a budget. A budget is a written spending plan that helps to create an outline that distinguishes immediate spending as opposed to saving now and spending in the future. Each individual’s budget is quite different since it should be based on an individual’s priorities. A good budget should include your net pay, any fixed expenses (e.g. monthly rent), variable expenses (e.g. groceries), and savings expenses (e.g. irregular, goal, and emergency spending). As a student, it is crucial to budget not only tuition, but also other school-related costs, such as incidental fees (totaling an average of $1800 per year) and textbooks, platform subscription fees, and supplies (totaling an average of $1000 per year). In terms of savings expenses, it is important to set short-term and long-term goals to figure out how to spend your money.

A starting point to set these goals can be done through the SMART goal template below:

- My goal is:

- I want to achieve it in: (time frame/by a certain date)

- The total cost of my goal is:

- I will set aside $____ to achieve this goal

Financial Aid

The University of Toronto offers various forms of financial aid for student

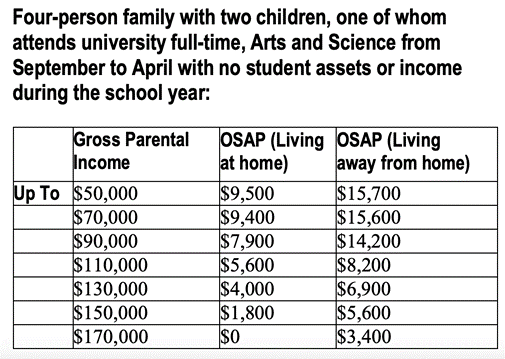

1. OSAP is a government-funded financial aid program that assists eligible Ontario university students through grants and/or loans. Although OSAP depends on many different factors, to help with potential planning, a general estimate of how OSAP operates is given in the table below:

Learn more here: https://future.utoronto.ca/finances/financial-aid/osap-and-other-government-aid

2. Scotiabank Line of Credit gives students the option to borrow funds from Scotiabank through the Scotia Professional Student Plan (SPSP) or ScotiaLine for Students (ScotiaLine). Learn more here: https://future.utoronto.ca/finances/financial-aid/other-loans-and-student-lines-credit/

3. UTAPS Grants offer full-time students varying amounts based on the student’s needs. This grant is for students who are already receiving maximum government financial aid but whose existing funding does not cover all university costs. Learn more here: https://future.utoronto.ca/finances/financial-aid/university-of-toronto-financial-aid-utaps/

Financial Counseling

The University of Toronto offers financial counseling to all undergraduate and graduate students to help plan and budget your finances. This can include creating a budget for the upcoming school year to ensure you have access to all financial assistance available.

- At the Faculty of Arts and Science, this counseling is available through the College Registrar.

- AT UTSC: https://www.utsc.utoronto.ca/registrar/financial-aid-advisors

- At UTM: https://www.utm.utoronto.ca/registrar/financial-aid-resources/financial-aid-advising

- At the School of Graduate Studies: https://www.sgs.utoronto.ca/awards-funding/financial-aid-advising/

Important Note: Filing Taxes

It is crucial to file taxes annually by April 30th regardless of income, as late-filing penalties could occur if you owe taxes. Furthermore, failing to file taxes on time could lead to subsidies or benefits such as the Guaranteed Income Supplement, Canada Child Benefit, Working Income Tax Benefit, and more, being delayed or stopped completely.

March 7, 2022.